Why “Make Money Now” Systems Almost Always Fail

Most people who try affiliate marketing don’t quit because they’re lazy or unrealistic.

They quit because the system they were taught was built to rush them. What many later describe as an affiliate marketing failure usually has more to do with pressure and poor structure than effort or intelligence.

It usually starts the same way.

Big promises. Simple steps. A sense that this time it’ll click.

Then the tactics start changing.

Funnels. Ads. SEO. Social media. One new “working method” after another. And when results don’t show up, the explanation quietly turns personal: you didn’t move fast enough, didn’t push hard enough, didn’t commit fully.

That pattern isn’t random.

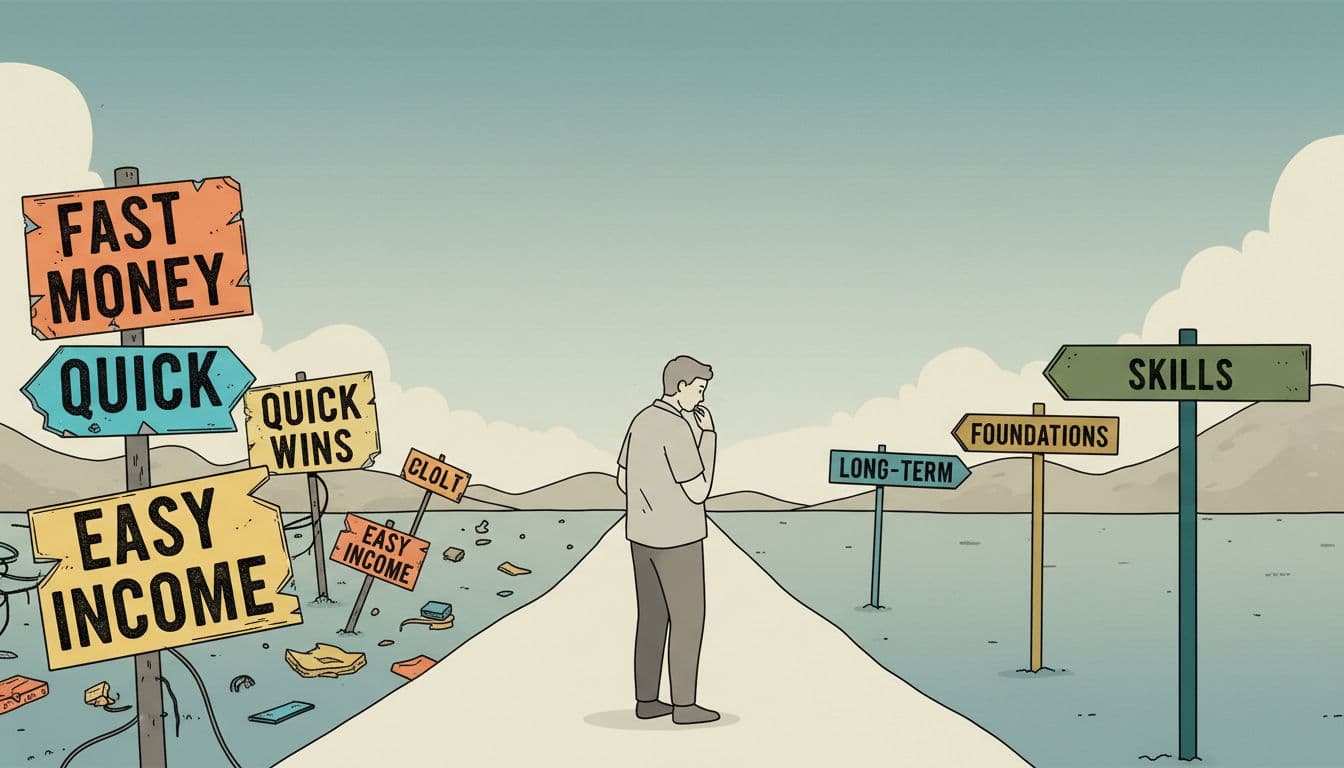

Most “make money now” systems are designed around urgency, not skill. Speed is rewarded. Understanding is skipped. The real product isn’t the method, it’s attention and hope.

Affiliate marketing, in reality, isn’t trick-based.

It’s skill-based.

And skills don’t grow under pressure.

When you’re pushed to monetize before you understand what you’re doing:

- You only see fragments, never the full picture

- Activity starts to feel like progress

- Failure feels personal, even when it isn’t

That’s why so many capable, motivated people walk away believing they’ve experienced an affiliate marketing failure, when what actually failed was the way they were taught to approach it.

What collapsed wasn’t the idea of affiliate marketing.

It was the model.

Short-term hype can’t support a long-term business. Foundations aren’t exciting, but they’re the only part that lasts.

Once you understand why affiliate marketing failure is so common, the past starts to make sense.

Not dramatically. Just clearly.

And clarity is where a better approach finally becomes possible.

This site has such a welcoming and practical vibe. It’s refreshing to find a finance blog that balances clear, actionable strategies with a real sense of encouragement—especially for those of us who might be starting a bit later or feel intimidated by complex jargon.

A quick question from a new reader: For someone just beginning to build their financial literacy, what would you recommend as the very first post or key topic to explore here on Wealth With Mike? Also, what’s a common misconception about building wealth that you find yourself addressing most often with your community?

Looking forward to diving into your archives. Thanks for creating a space that makes finance feel accessible.

Thanks, Cian

I really appreciate you taking the time to say that.

For someone just starting out, I’d honestly point them to the basics around how money actually moves, not tactics. Things like understanding cash flow, building a buffer, and learning the difference between income that trades time for money versus income that scales. A lot of people skip that and jump straight into “how do I make money fast,” which usually backfires.

As for misconceptions, the biggest one I see is that building wealth is about finding the right system or the perfect strategy. In reality, it’s more about consistency, patience, and not quitting when things feel slow or boring. Most people don’t fail because they chose the wrong path — they fail because they expect results before the foundation is there.

Glad to have you here, and feel free to dig around. The archives aren’t going anywhere.